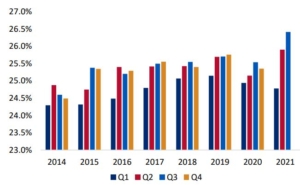

After a pandemic-induced dip in 2020 and low start to 2021, the gross margin of a majority of the 16 publicly traded staffing firms tracked by SIA appears relatively strong in the third quarter. As shown in the accompanying chart, the group experienced a drop in 2020 across all quarters relative to 2019. After a slow start first quarter, quarters two and three have been the strongest two across this entire measurement period back to 2014. For the period from 2014 through 2021, first-quarter gross margin has averaged at least 60 basis points lower than the other three quarters, which is attributed in part to higher payroll taxes in the beginning of each calendar year.

What is gross margin? Gross margin is the difference between what your supplier bills you and its direct costs of employment (pay rate plus burden and/or mandatory benefits). In the US, burden will include workers’ compensation, unemployment insurance, employer’s share of FICA and state or local taxes for each temporary employee on assignment. In Europe, mandatory benefits vary per market but will generally include employment tax and social insurances.

Why it matters. In economic terms, the size of a staffing firm’s gross margin should roughly correspond to the cost of its recruiting and sales activities, as well as correspond to the economic value added by its staffing services. Knowing your supplier’s gross margin percentage can provide insight into your supplier’s business strategy (whether low cost or high quality), its financial health relative to its peers and serve as a predictor of future bill rates as gross margin reacts to the business cycle.

Source: Gross Margin and Bill Rate Trends, December 2021 Update

The report is available to members of the CWS Council.