With 2021 approaching, many companies are strategizing how to rebuild their talent. Beyond direct sourcing and managed services, another possibility for your talent acquisition strategy is recruitment process outsourcing, or RPO. The global RPO market realized a whopping increase of 18% in 2019 and is forecast to bounce back from a modest decline in 2020. Here’s what it is, and why and where you would use it.

As defined by SIA, RPO is the partial or full outsourcing of the internal recruitment function to a third-party specialist provider, which provides the necessary skills, activities, tools, technologies, related recruitment supply chain partners and process methodologies to assume the role of the client’s recruiting department.

Our latest report, “RPO Global Landscape 2020,” helps human resource, talent acquisition owners and stakeholders to:

- Understand the size and maturity of the RPO market across the globe

- Gain visibility into trends about the evolution of talent acquisition for permanent workers

- Identify the predominant model(s) being used

- Understand how a given provider is positioned in the market

- Create a short list of prospective RPO providers

- Confirm veracity of provider statements

- Identify strengths and weaknesses of providers

Here’s how RPO use breaks down:

Geography. The geographic scope of most RPO contracts remains in a single country (64% of reported contracts) but multi-country and global deals account for a hefty portion of revenue, and our research shows that this is a growing trend.

Scope. While the market is somewhat mature, most companies are not outsourcing 100% of the recruitment function to an RPO. Many prefer to outsource services for part of the enterprise or engage in Project RPO solutions to meet a specific need; a recent example is the demand generated by Covid-19 in certain sectors.

Size. Large organizations (those with more than 10,000 FTEs) are more likely to engage an RPO, and a global contract at a large company can cover 10,000 hires per year, although the average number of annual RPO hires per annum is 700.

Industry. The finance/insurance industry has the lion’s share of reported RPO contracts followed by technology/telecom, manufacturing and pharma/biotech/medical equipment, while adoption in industries such as construction utilities and advertising is far lower with just 1% of market share by contract volume across each of these sectors.

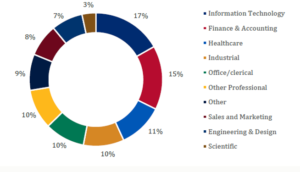

Providers of RPO deliver mostly professional roles and IT is expected to continue to be the most in-demand skill growth area. However, healthcare and finance and accounting are not far behind as shown below:

RPO Market by Occupational Skill

RPO is a viable remote workforce solution that can be supported by offsite and onsite delivery staff and can be located onshore, nearshore or offshore. Typical services now include sourcing, market mapping, talent pipelining, administration, onboarding and management information support and 61% of reported clients utilize end-to-end services. Many companies are getting ready to rebuild talent for 2021 and considering RPO as a very real possibility.

RPO is a viable remote workforce solution that can be supported by offsite and onsite delivery staff and can be located onshore, nearshore or offshore. Typical services now include sourcing, market mapping, talent pipelining, administration, onboarding and management information support and 61% of reported clients utilize end-to-end services. Many companies are getting ready to rebuild talent for 2021 and considering RPO as a very real possibility.

SIA’s RPO Global Landscape 2020, available to CWS Council members, helps you grasp the contours of this market and find the answers you need.