The discussion of background checks is ongoing as the challenges are always changing and the tools and services to facilitate the process also continually evolve.

For example, the increase in remote and gig work has made it much harder to validate that the person doing the work is actually the person who was initially screened.

“Some level of identity verification is the primary solution there. You need to validate,” says Kristen Faris, senior VP, customer success, solutions and partnerships at background screening firm Checkr.

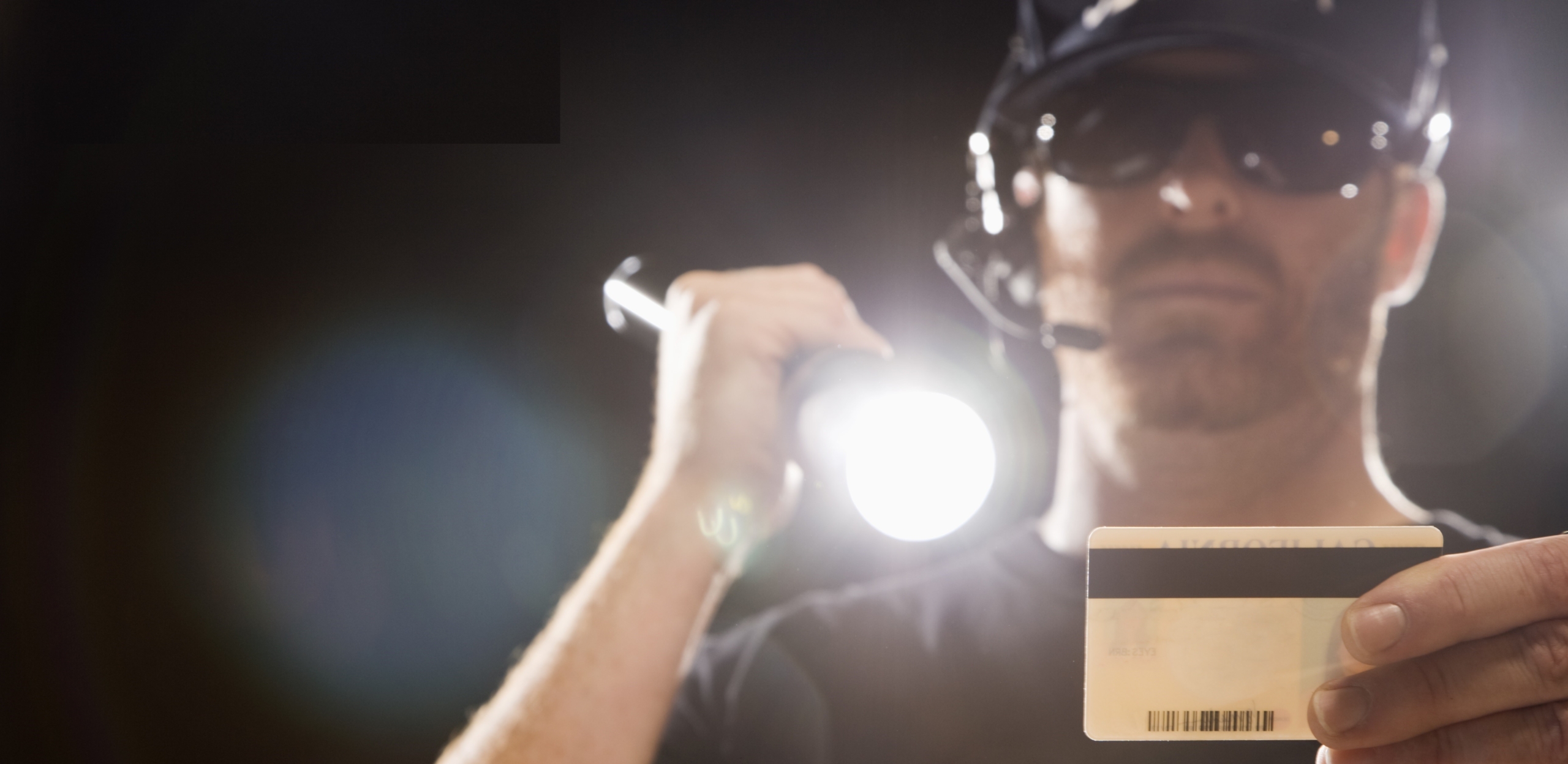

Hence, companies are increasingly looking into identity verification-type solutions, or IVS. Such solutions can include having the candidate take a picture of themselves holding their identification or having them upload separate photos of themselves and their ID to undergo a matching process. It can also be as light as having a day supervisor conduct a quick ID check when they show up for their first day of an on-site shift.

The illegal practice of “bait and switch,” whereby different people perform steps in the hiring process, can become a problem at any stage in the work engagement process. In addition to initial job applications, imposters also find ways to take part in the interview and onboarding processes and even perform the temporary work assignment or accept the job.

Staffing buyers and their providers should identify and close gaps of bait-and-switch vulnerability in their recruiting and assignment processes, advises attorney George M. Reardon in a Staffing Industry Review article.

“Photos are one tool for confirming personnel identities,” writes Reardon, who specializes in staffing industry law. “Résumé and personnel file pictures have long been discouraged because, although using them is not generally illegal per se, they have raised questions about why employers would need pictures — other than to facilitate illegal discrimination. The answer to this question may be that pictures can confirm workers’ identities in all stages of assignments, helping prevent bait-and-switch scams.”

AI: Friend or Foe?

Background checks have traditionally been a very manual process, but providers are now focused on automating that process where possible for a variety of reasons. However, the potential for problems, including discrimination against candidates, has not gone unnoticed.

“Regulators and lawmakers are increasingly focused on the use of AI in the employment decision process and potential for discriminatory bias,” says Angela Preston, senior VP and counsel, corporate ethics and compliance at Sterling, a background screening and identity verification provider. “The EEOC is investigating and enforcing antidiscrimination laws in light of the use of AI decisioning tools in the employment context.”

But despite the potential for issues, the benefits remain — especially with challenges emerging due to ever-increasing and varied state and local regulations.

“We might as well have 52 different countries when it comes to the difference in background checks across states and jurisdictions,” Checkr’s Faris says.

“There are all of these different kind of bespoke nomenclature across different jurisdictions,” she continues. “And so, we’re leveraging machine learning to really help to classify those so that we don’t have to have an individual person try to decipher each of those different classifications, and then we can apply automated adjudication.”

It is changing what has traditionally been a very manual process of an individual examining a customer’s adjudication criteria, looking at a background check and then manually applying those rules.

“We’ve built rules engines that help to automate that, which can shave hours or days off of the process — and really, in today’s market, we have customers measuring turnaround time or throughput in 15-minute increments because an additional 15 minutes can make the difference between getting a candidate and not getting a candidate, particularly in the gig space,” Faris explains.