A net 53% of staffing firms reported an increasing trend in bill rates over the last three months and a net 42% expect an increasing trend in the next six months, according to SIA’s May 2022 Pulse Survey, released last week.

Published every other month, SIA’s US Staffing Industry Pulse Survey Report provides the contingent workforce buyer with insight into the suppliers’ environment and how it affects their programs.

Wage inflation and bill rates. The survey overall provides some additional insight into bill rates.

This most-recent pulse survey asked participants, “What (if any) impacts have you seen from wage inflation in 2022?” The question garnered responses from 84 staffing companies.

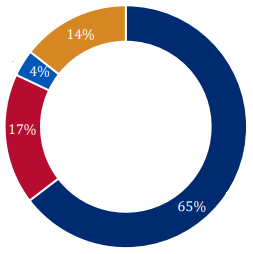

Nineteen companies, or 23%, responded that bill rates/pay rates had increased. By sector, commercial staffing providers were most likely to share that bill rates/pay rates had increased because of wage inflation; 42% of commercial staffing suppliers indicated this.

In addition, 11% of responding companies shared that margins were being squeezed because of wage inflation, and 8% noted that positions were harder to fill.

Among healthcare staffing providers, 20% pointed to margins being squeezed, and in the “other professional or multi-segment,” 15% shared that they had been facing an increase in no-shows or assignment dropouts.

Staffing firms participating in the Pulse Survey reported a median 21% year-over-year increase in their US temporary staffing revenue in April, down from the 25% year-over-year increase in February. In addition, the net increase in new orders of 52% was the lowest since August 2020.

Sales difficulty increased to 2.50 from 2.37 and recruiting difficulty increased to 3.65 from 3.58 (on a five-point scale). Both values are still below and above their respective historical values, but a convergence recently seen between the two could point to a loosening of the labor market that would benefit staffing buyers.

In their words. Comments from respondents include:

- “Clients demanding reduction in bill rates and candidates demanding increase in pay rates squeezing our margins to the point of being difficult to run the business.” — Commercial staffing firm

- “Health systems are working to push bill rates down, even to the extent of lowering bill rates mid-contract. The impact is to see nurses vacate these contracts and migrate to contracts that can support higher wages. Lowering bill rates too quickly will create contingent labor shortages in facilities and put additional pressure on perm staff. This could result in another wave of resignations of perm RNs who are unhappy with higher nurse-patient ratios or increased hours.” — Healthcare staffing firm

- “Clients slow to respond to increased wages or not moving quickly enough to hire someone they can afford.” — IT staffing firm

- “Inflation has outpaced our annual yearly raise of 5%, so employees are earning less dollars YoY despite a 5% raise. We have seen record-breaking bill rates all of 2021 and 2022; however, clients have begun to push back the past few months citing inflation and rising operating costs.” — Other professional or multi-segment staffing firm

The “May Pulse Survey Selected Findings” report is available for download to the CWS Council members.

The survey included responses from 161 staffing firms.