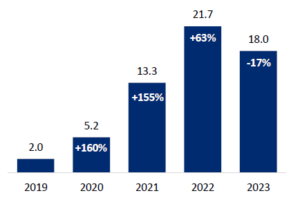

Spending worldwide through temporary staffing platforms reached $18 billion in 2023, representing a year-over-year decrease of 17%, according to Staffing Industry Analysts’ Temporary Staffing Platform Update: 2024 report.

Despite last year’s decline, temporary staffing platforms have achieved a compound annual growth rate of 73 % since 2019.

SIA’s Lexicon defines staffing platforms as “a segment of the staffing industry representing the automated/online version of the offline processes conducted by staffing firms.” They take the two-sided digital labor marketplace, ratings and other systems of online talent platforms but use the traditional staffing firm pricing model.

Examples of firms operating professional temporary staffing platforms include Randstad and The Adecco Group.

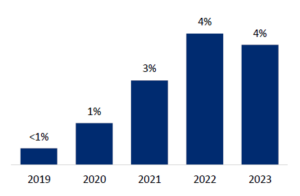

While the platform’s market shares remained unchanged at about 4% in 2023, it continues to expand its share on a segment-to-segment basis. Most notable is the outsized platform exposure to healthcare staffing, which represents nearly two-thirds of the global temporary staffing platform market, according to the report. This is compared to non-platform temporary staffing, where healthcare contributed only a 10% to 15% share in 2023. Where temporary staffing platforms have proven to be effective in adding to overall growth is in terms of scalability, or the benefit of processing efficiencies which enable platforms to handle spikes in demand compared to the traditional staffing model.

Worldwide temporary staffing platform market, $ billions (year-over-year change in columns)

While the platform share of the global temporary staffing market remained unchanged at about 4% in 2023, it continues to expand share on a segment-to-segment basis.

Staffing platform share of temporary staffing market, worldwide