In a challenging labor market, program managers may be tempted to add to their supplier pool, but taking a step back to evaluate the providers already in your program can be a much better approach.

Staffing suppliers come in all shapes, sizes and specialties — from those that fulfill a specific need to generalists. There are diverse suppliers, offshore or nearshore suppliers and purple squirrel finders.

Finding suppliers eager to support your contingent workforce program is easy. But it’s not so easy finding suppliers that understand your company culture and hiring needs to the extent your roles are filled with a candidate who fits in on time at reasonable rates. And when you’re evaluating your supplier pool, how do you weigh the needs of your contingent program against the need of adding or subtracting suppliers?

It begins with understanding that adding more suppliers doesn’t solve many problems. Asking yourself if you have the right suppliers is key. The suppliers that are in your program now were added for a reason, and if they aren’t fulfilling that reason, it’s time to re-evaluate. But before you decide to add or remove, it’s important to look at the types of suppliers you have now and where they fit on the Supplier Maturity Model to determine whether they are at the right level or if you truly have a gap.

From my experience, suppliers can offer much more than meeting metrics, and it’s important to realize where you should focus your energy and where you need patience or an exit plan. Unlike your typical scorecard, I’ve built this guide to help you determine where your current suppliers sit with regard to the areas that cannot be measured.

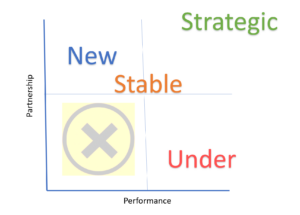

Supplier Maturity Map. Place suppliers on the grid based on: New – Opportunity for growth; Stable – Maintain or grow; Strategic partner – Key player; Underperforming – concern area.

New. Partners new to your program represent an opportunity for growth. They are learning the rules, getting their feet wet and starting to build relationships. In general, limit this designation to suppliers that have been in your program for six months or less.

Stable. These are the suppliers that have the potential to maintain and grow with your program. They are reliable, consistently deliver talent and have good relationships with your stakeholders. They may serve a niche or specific category, be looking to grow or have a more focused approach. In general, these firms have been with your program for one to three years.

Strategic partner. These suppliers are key players within your program. They are trusted partners that look for ways to improve the program performance, bring new ideas to the table and know the business better than most employees. Their tenure with your program varies.

Underperforming. These are the suppliers whose performance requires monitoring. Their delivery is inconsistent, leaving you unsure whether they are able to support the business. They may need to refocus their efforts in terms of roles they support in your program. Their time within the program also varies.

Using the map is straightforward. Assess each supplier based on the above criteria and place it on your maturity map. Those in the lower left quadrant are those you should consider removing from your program.

After you’ve completed this supplier analysis, you can explore adding suppliers to your program.